Do you lie awake at night, trying to figure out how to make money from your own kid’s recess? Do you sometimes wonder how you can turn your non-asset-producing children into better profit centres?

There’s a knack to being rich, and not everyone has what it takes.

If you’re traumatized that your local school went on the chopping block this week, why not ensconce your child in private school, where you too can learn the secret code of money?

Take St George’s School on Vancouver’s leafy west side. So much more than just a school, “Saints” is also a taxpayer-subsidized babysitting service for boys.

When your kids are on recess break in the public school system, you hope they don’t break anything falling off the monkey bars. When they’re at Saints, you lean back and think, “Isn’t this beautiful,” while your tax gains roll in.

That’s because to Revenue Canada, lunch, recess and after-school activities at elite private schools aren’t education, they’re day-care. The CRA grants over $3600 in annual child-care deductions against the tuition cost of every student at St. George’s, until the age of 16.

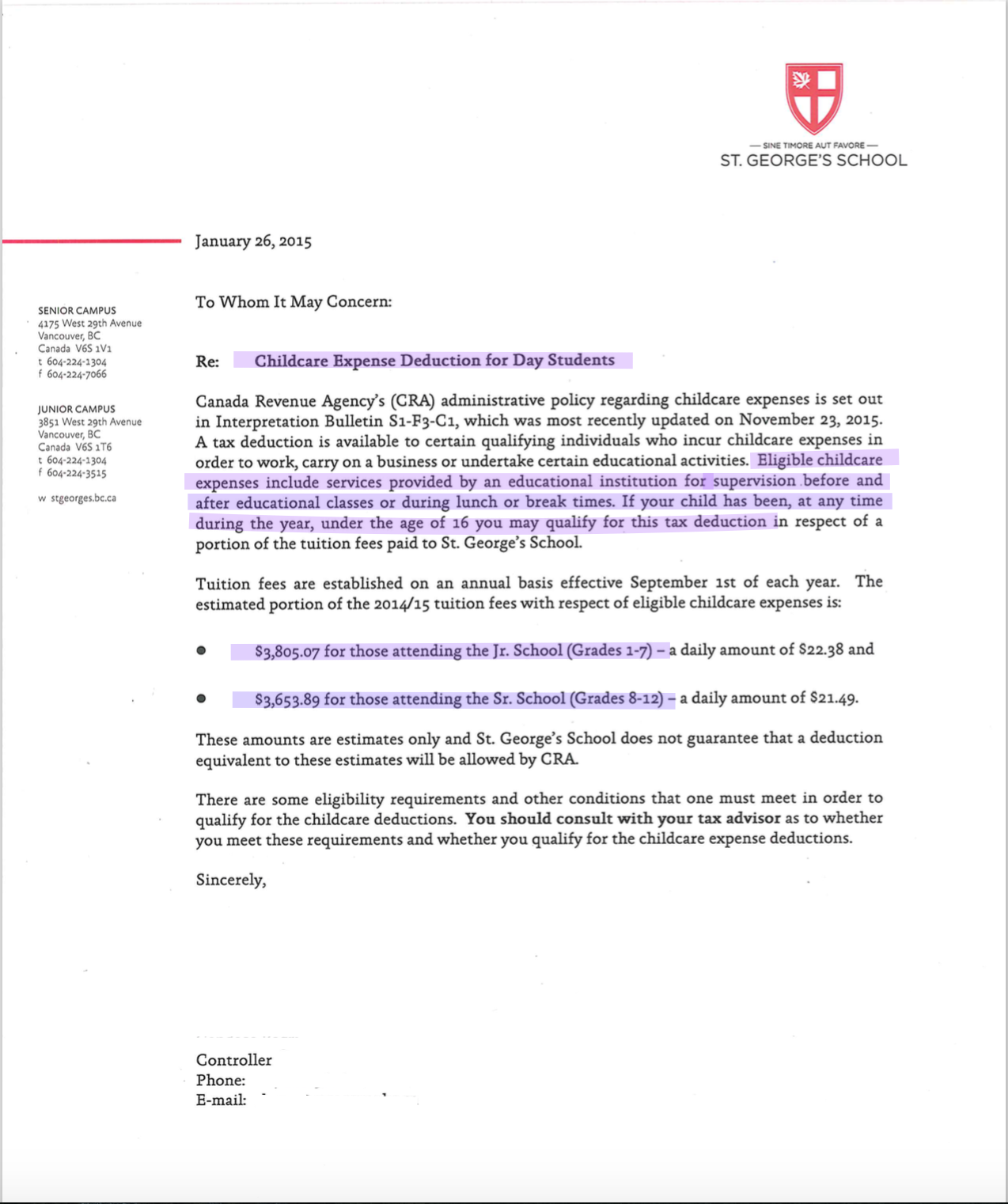

Here’s the Saint George’s letter from 2015, showing the calculation of tax deduction on their $20,000 plus tuition:

St. George’s isn’t unique. All parents of private school students in B.C. — in fact across Canada — can claim a child-care deduction for a portion of their private school tuition. We’re talking tens of thousands of elite private school kids getting a free lunch on the public dime.

Just part of the rich secret handshake club. The rich have lots of secret clubs. You don’t know about them till you’re in one.

But wait, there’s more! (You knew there was more).

That child-care deduction is just the start of the private school tax party. When you’re rich, every day’s your birthday and everybody’s your friend. Your private banker will be almost like a member of the family. They’ll know the names of your kids, your in-laws and your parents, too.

A caring community makes such a world of difference.

And RBC Dominion Securities has some advice on how to finance that $20,000 tuition, tax free.

It’s simple really. Just loan about a quarter mil to a family trust. Your lawyer and accountant can set one up. Then your low-income child can earn up to $18,000 in dividend income totally tax free, which will pay most of that private school tuition. Add in your own child-care credit, and you’re covered — 100 per cent tax free tuition to the private school of your choice.

You can even have the trust repay the loan back to you after your kids have finished school. Or whatever, maybe just put a deposit on a condo for them.

If you don't have several hundred thousand dollars in liquid cash, try converting to Catholicism. If your child goes to one of the Catholic or religious schools, most of their tuition is tax deductible. The elite Catholic boys' school Vancouver College, issues a tax receipt for 80 per cent of tuition, according to their website:

But wait, there’s even more. Of course your private school has a lobbyist to meet the Finance Minister and the Minister of Education in Victoria and lobby for tax exempt status for your school property, saving up to nearly a million dollars a year. Now that lobbyists, (like your private banker, lawyer and tax accountant) are just part of your world now, things seem to get done almost effortlessly.

Then there are the provincial government grants of over $3,000 in subsidies for every loveable mop-top you bring into the private school system. The millions in total taxpayer subsidies to the school sure help to cover the hundreds of thousands of dollars in fundraising costs.

The provincial government’s increasing grants to private schools have created a much-needed sanctuary for parents exhausted by years of strife, strikes and traumatizing cuts in the public system.

And don’t fret about the public getting upset when they figure out all the the things they’re paying for, what with public schools closing across the province.

Your lobbyist can deflect any criticisms by pointing out all the money you're saving them. That usually throws them off the scent.

And with all the new friends you’ve made, you won’t really ever have to meet anyone from the public system anymore. Except maybe if you accompany your child on a community service trip to one of the east side schools that are still open. Service to the less fortunate is essential to character-building in the young.

But you don’t need to go yourself if it makes you feel uncomfortable.

And of course to top everything off, your new private school is a registered charity, so you too can make a name for yourself by donating to their multi-million dollar endowment and capital funds.

Giving selflessly to support the wonderful cause of education is so good for the soul.

Never was public education

Never was public education meant to be given free to private schools, The shortfall in public education funding is in direct proportion to increased funding to private education. CC and her liberals have driven family's out of public education with fear and lies at the quality of teaching The constant attack against public education the court cases the Government keeps losing against the Teachers further erodes the system while CC and her Liberals keep wasting tax payers dollars. The Liberal Government does not care about 90% of the Family's in BC in fact her disrespect and contempt is shown in ever misleading statement she makes and her actions around public education speaks more than her true beliefs which is cater to the money players.

Comments