If we’re going to talk about real estate and globalized capital in Vancouver (and we are), we have to talk about race. Those are the Vancouver rules, so we'll get there.

But first, some facts.

Anyone feeling chirpy about the rosy state of BC's economy should take a long hard look at Alberta, and never say "Never."

Why it matters where the money's from

If you think the foundation of BC's economy is the resource sector of forestry, mining and oil and gas, give your head a shake. According to Business in Vancouver Metro Vancouver's residential real estate is by far the largest industry in the province, clocking in at $38.6 billion revenues in 2015. That's more than three times the size of mining, forestry and oil and gas, which have a combined value of $12.7 billion.

That's a lot of money, and it's a lot of risk.

China matters in Metro Vancouver's housing debate in the same way Saudi Arabia matters to Alberta. If Beijing sneezes, Vancouver will catch pneumonia, just as Alberta did when Saudi Arabia cut its oil prices by more than half.

Everyone who understands international finance knows of China's titanic struggle to contain its unprecedented capital outflow crisis, estimated by Bloomberg at $1 trillion US in 2015 alone. That's seven times larger than 2014.

By remarkable coincidence, 2015 was also the year that a mysterious wave drove Metro Vancouver's housing market into Ludicrous Mode™, with home prices rising 37 per cent year over year from May 2015 to 2016.

If the Chinese government ever throttles that gusher, Vancouver's real estate party will sober up overnight.

The hangover will be a world of pain.

It doesn't matter if we're for or against foreign buying, because we all depend on it in ways we don't even know. Tens of thousands of jobs hang in the balance, as do hundreds of small businesses and the life savings of most new home-owners.

When China cracked down on cash flowing through Macau's casino VIP rooms in 2015, that economy contracted 20 per cent in a single year. $46 billion evaporated from the market value of the casino industry.

That's why relying on a single buyer matters. We're no longer master of our own house.

Bizarrely, it has been like pulling teeth to get the provincial government to quantify foreign capital flowing into the metro housing market, though they've been happy to trumpet purely imaginary numbers from the fantasy garden LNG industry. Anyway, capitulating to overwhelming political pressure, they finally made a half-hearted effort, delivering a rushed and spun set of numbers in early July.

You might think the important number is three. As in three per cent of the market is attributed to foreign buyers. As always with the Clark Liberals, you have to sharpen your own pencils on their numbers. Because it's a lot bigger than that.

Extrapolating from De Jong's very small sample size, it's foreseeable that foreign buyers could pour as much as $5.5 billion into Metro Vancouver in 2016 (adjusted for seasonal variations). Those dollars are heavily concentrated in the two municipalities with the greatest runaway housing inflation: Vancouver and Richmond. If current ratios hold, $5 billion will come from a single source country: China. That's larger than BC's entire $4 billion mining industry, with one striking difference: it's virtually tax and royalty-free.

Foreign buying is eight times higher in Richmond than outside Metro Vancouver

According to Finance Minister Mike De Jong, over some 19 days in June, foreign buying accounted for 6.5 per cent of the total value of residential sales in Metro Vancouver--rising as high as 14 per cent in over-heated Richmond. Compare that with the much calmer and more conventional market outside the metro region, where foreign buying accounts for less than 1.8 per cent of all home sales. (derived by subtracting the metro data from the BC-wide data).

In other words, foreign buying in BC's hottest market is roughly eight times higher than outside the metro area.

The much larger Vancouver market is harder to quantify, because sharply divergent neighbourhood patterns don't appear in the data. But it's worth noting that $64 million dollars entered the Vancouver market in just 19 days, the highest in any municipality.

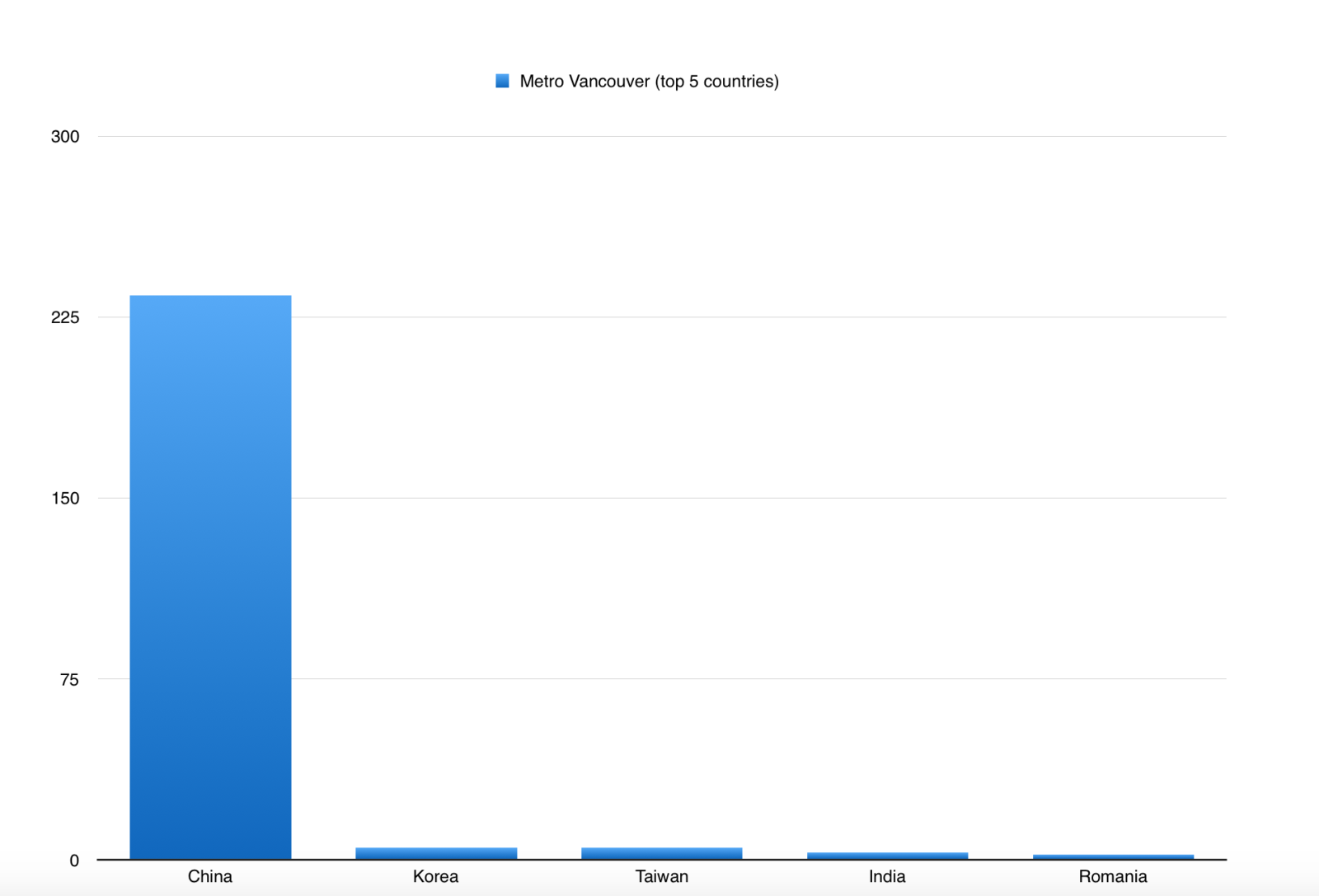

And diversification of buyers is much greater outside Metro Vancouver than within, where China accounts for 90 per cent of all transactions. Korea and Taiwan are the next highest, at only two per cent. Notably, while American buyers comprise a third of foreign buyers outside the city, they bought nothing within it.

Total transactions by top five purchasing countries, based on Government of BC data:

De Jong's numbers don't include untracked and invisible dollars entering the market through purchases by investor immigrants and permanent residents such as this local couple who own ten Vancouver properties valued at $152 million. South China Morning Post journalist Ian Young identifies investor immigrants as the primary source of foreign capital entering the Vancouver market, but the government doesn't track this.

And what do local sellers do with their foreign-sourced dollars after the initial point of sale? If they're not dead or skipping town, they'll have to get another place to live. So those foreign dollars re-enter the market in domino transactions, only this time we treat them as domestic purchases.

There's no tracking of the cumulative impact of the multiplier effect of those billions of dollars moving through the housing market. But we can watch it in action, through this time-lapse gif charting Andy Yan's research documenting the rise of prices across Vancouver.

via GIPHY (Data: BTAWorks, gif Justin Todd @Instagiffer)

While we're still far from fully understanding the marketplace, it's clear that foreign capital entering the market correlates very strongly with residential real estate inflation. The higher the incidence of foreign buying, the higher the property inflation.

Real estate gamed by insiders while Christy Clark plays Marie Antoinette.

Meanwhile, the premier does a great impression of someone who doesn't give a fig. While our housing market smacks of an industry gamed by insiders, Christy Clark exhibits the temperament and principles of Marie Antoinette.

Smiling brightly, she resists all but the most cosmetic response to solving the housing and shelter crisis, the most pressing social justice issue of our time.

Although BC faces enormous risk from changed policies in China, I don't know a single person familiar with that country who thinks it can or will control the movement of cash long-term. The more likely outcome is some variation of the status quo--continuing and potentially accelerating the severe destabilization of housing in the city.

Political expedience and ineptitude by the provincial government led us into this morass, and there's not an exit in sight.

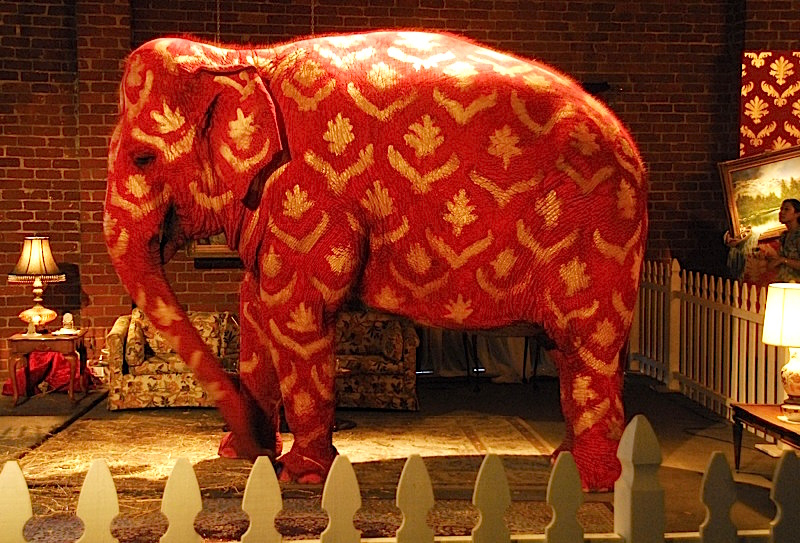

Yet somehow we can't even talk about this, because we're paralyzed by fear that a racist backlash against Canadian Chinese will arise if we say or do anything about it. But avoiding a rational debate about the elephant in the room hasn't done any noticeable good in suppressing racist jerks.

Little could be more symptomatic of Vancouver’s real estate derangement syndrome than journalist Ian Young’s report that the Canada Revenue Agency is nervous about being labeled racist over tax fraud investigations in Vancouver. Even our tax auditors are twitchy about checking on home buyers in Shaughnessy who claim tax credits for the working poor.

I tend to think of racism discussions like parent-teacher interviews. The people who really need to be there never show up.

Nobody should ever be complacent about racist incidents or fears by minorities. It's our responsibility to conscientiously deal with it whenever we encounter it.

At the same time, let’s not forget what we stand for in this community. And what we don’t.

When Harper's gang tried to stoke Islamophobia, we threw the bums out

It was less than a year ago that Harper’s gang tried to stoke Islamophobia for political gain. That caught fire for a few weeks--even frighteningly so--but then everybody got a grip and threw the bums out. And there's no way that Donald Trump or Nigel Farage could ever get elected dog-catcher in this town.

Not only do we care passionately about this stuff, most of us are either minority or immigrants ourselves, or count them among our close family and friends. Racism is an undeniable part of Vancouver's history and its life today (just check the comments section of ANY news story involving a minority).

Yet overall, the public also has a lot more common sense than many observers give them credit for.

Oh, and my South Asian husband insists on interrupting this column to say his piece. Which is the following.

While everyday racism is still too commonplace, minorities today don’t suffer in silence, waiting to be rescued by white knights.

Vancouver’s changed a lot from the town he grew up in decades ago. One of the biggest changes is that minorities have their own voice and powerful hard-won platforms in media and public affairs. They don’t need others to speak for them. If there's a problem, we're all going to hear about it. If anything, we need to encourage those voices more.

End of interruption.

So it’s especially welcome to see Canadian Chinese members of Vancouver's community step forward and vigorously contribute their expertise and divergent opinion on the real estate and racism debate. Yuen Pau Woo, Fenella Sung, Justin Fung, Eveline Xia, Victor Wong and many others add nuance and depth to the discussion.

The caution over race and racism has many facets, yet two in particular stand out.

One is the fear that raising the issue of foreign buying will embolden racists and fan existing embers of racial hatred. This is a wholly legitimate concern that imposes a positive duty on all to be constructive and respectful.

Yet a more insidious undertone dominates the current debate. Many implicitly or even explicitly question the motives and integrity of those pressing for more government action. It's a cheap (and lazy) shot to insinuate that someone is racist merely for raising concerns (or collecting data) over the vast amounts of foreign money flowing into our housing.

Most Lower Mainlanders know the difference between fair and unfair debate, and they have a nose for when accusations are used to stifle important conversations. They're not falling for it.

What makes us so sensitive to the racism charge is precisely the same thing that sets the real estate issue ablaze: our deep and abiding sense of fairness. Vancouverites have faith that due process and good governance will protect the public interest, and they don't trust Christy Clark to deliver.

For reasons that remain opaque, the premier and her government continue to run from this issue.

We can protect minorities and address foreign capital impact on housing

At the end of the day, this debate is not as complicated as it may seem. Does it really need to be said that minorities and immigrants are Canadians, not foreigners? They're entitled to be protected from racist attacks, and we must, at the same time, address the flow of international capital that's destabilizing housing supply and exposing us to enormous risk.

Properly taxed and channeled through appropriate regulation and governance, this capital could and should yield tremendous net benefits to BC. It can provide stable and predictable employment, government revenues for health care and education, and a host of positive spin-off effects. All the things we were promised that LNG would deliver.

If this were all well managed by a responsible government, we'd be grateful for the benefits of foreign investment, instead of fighting over it.

It's long overdue for Christy Clark to demonstrate she understands government isn't an acting job.

If she can't do that much, she could at least act like a leader.

Farmland in the Prairies and

Farmland in the Prairies and many other areas is now being bought by foreign speculators and other nations to the point that scarcity has rocketed prices. In parts of Africa and elsewhere large tracts of forests have been razed by countries that bought it with the lumber exported to that country. Crops are then grown, depleting local aquifers already in drought, and the crops are exported to the country owning the land. The water is permanently removed from local aquifers and despite food shortages or even famine, none of the crops are retained by the country they were grown in. This will happen here if we don't force laws on foreign property ownership.

Global Overpopulation is the driver of most of the world's problems and we must force governments to abandon their 'breed more drones' failed economic models in favour of negative population growth in every country worldwide.

Comments