There’s a global pandemic. A deep recession. And a federal budget deficit the size of last year’s revenues.

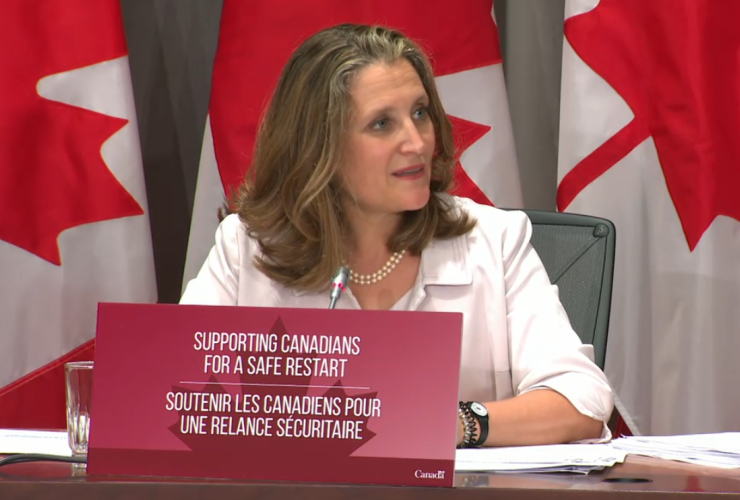

Chrystia Freeland is becoming finance minister in interesting times.

To make matters even more interesting, the country is divided. Like so many times in the past, it’s divided along political lines, with a minority government and five parties jockeying for position in the House. But just as importantly, COVID-19 has revealed deep rifts in a Canadian society that is divided along the lines of income, gender, and race.

This is the Canada the prime minister contemplates as he drafts next month’s speech from the throne. Based on news reports, Justin Trudeau’s goals are ambitious: to lift the country out of recession, to address inequality, and to transform the economy in response to the ongoing climate emergency. Minister Freeland’s job is to finance those plans, and to do so, she must begin with an assessment of where we are now.

We have learned a lot about the pandemic and its economic impact since the Canada Emergency Response Benefit (CERB) was first introduced in mid-March.

While most higher-income Canadians continued to earn their salaries and safely work from home during the shutdown, many more low-wage workers found themselves either unemployed or compelled to keep working at essential services that put their health and the health of their families at risk. Since the economy has started to reopen, women with children under 12 have lagged far behind men and other women in recouping their hours lost during the shutdown. Racialized Canadians, who are overrepresented in low-wage occupations and industries, are facing both higher rates of COVID-19 and higher unemployment rates.

We have also learned that decades of underfunding of public services and a tattered social safety net have worsened the impact of the pandemic. Public programs from long-term care to child care to employment insurance (EI) have not been up to the challenge of COVID-19. Even federal government computer systems have been taxed.

But the pandemic has had a silver lining: It has shown Canadians that, in a real crisis, a government can take quick, decisive action that solves problems and makes life better for everyone. We have been reminded of the value of public services and the public sector in our lives. As the pandemic continues and the climate emergency deepens, we can see clearly now that governments must take on a larger role in the economy and in society.

The throne speech must set out concrete parameters for the government’s recovery plan that go beyond repeating the words “green, equitable and inclusive.”

On Thursday, the government announced its plan to broaden access to EI and provide new income supports for unemployed workers who don’t qualify for EI for the next year. The ministers said the estimated costs for this were about $29 billion. That suggests a government that’s willing to spend money to support Canadians’ incomes, at least over the next year, but Parliament must approve the plan when it meets in September. And this is still a minority government.

In addition to income supports, any recovery plan must also direct money to rebuilding public services, with universal public child care at the top of the agenda so women can get back to work.

A plan to decarbonize the economy means signalling a definitive end to the fossil fuel era and ushering in a new vision for Canada: A diversified, green economy that works for workers and communities, serves the well-being of society, and drastically cuts our greenhouse gas emissions.

This is no time for half measures or pilot projects. For this plan to work, we must spend big. And that is where Chrystia Freeland must shine.

Freeland’s predecessor reportedly balked at new spending that could potentially equal what has already been shelled out for the COVID-19 response. Bill Morneau shouldn’t have. While the federal debt-to-GDP ratio has risen, the books are still in much better shape than they were through much of the 1990s. Interest rates have plunged to levels not seen since the Second World War, so much so that the cost of servicing today’s debt is actually lower than it was six months ago. Canada’s debt is an investment, not a problem.

Nonetheless, we will need more revenue to pay for an increased role for government and a less unequal society. That means raising taxes.

Federal tax revenues as a share of GDP are down substantially from where they were a generation ago. This change has fed inequality, leaving more and more of the country’s wealth in the hands of those who need it least. Despite COVID-19, Canada remains a rich country, but some redistribution is in order. From grocery clerks to personal support workers to everyone else who has been shortchanged by this economy, we all deserve a fair share of the wealth we have created together. Reforming tax rules that overwhelmingly benefit the rich is the tool to make it happen.

Minister Freeland has a clean slate, a rich country, and a golden opportunity in front of her.

It’s a great time to be the finance minister of Canada.

Excellent points. I do not

Excellent points. I do not rate the chances Freeland will take them on board very highly. Enthusiastic cold warriors are rarely committed economic progressives.

Most progressives, a pretty

Most progressives, a pretty fair majority of moderates and even a few economic conservatives would agree with the premise that spending big on the right things during a recovery is indeed an investment with an undeniable return. However, this is a long term venture and it will require a plan, something not seen or discussed even though there has been an ocean of rhetoric for years about a ‘transition.’

I believe it was Globe columnist Doug Saunders who found that Quebec’s $7 / day childcare program paid for itself over and again through the taxes paid by newly employed parents, mostly women who would have otherwise been out of the workforce minding the kids longer.

The International Energy Agency recently predicted that investment in renewables will exceed investment in fossil fuels for the first time in 2021, and that will cause a decrease in world oil demand. This may neatly dovetail with any notion Trudeau may float as part of a green recovery.

The IEA projection is remarkable in two ways. First, the organization has continually overestimated the expansion of the oil industry, though prices have been unstable for nearly 20 years, and habitually underestimated the attractiveness of renewable energy to investors who see a massive growth potential as the world turns away from fossil fuels. And second, the IEA has now removed itself as one of the chief data meisters underpinning rhetoric from fossil fuel-dependent governments, like Alberta, on the “expected” increase in demand for oil for decades to come, and the “necessity” to not interrupt the free flow of public largesse toward the industry.

Further, post-pandemic initiatives mustn’t ignore the tragedy that is occurring in senior’s care facilities during COVID times. It was thus for decades before coronavirus. Improved end-of-life care is, in my opinion, equally important as universal child care.

These and other recovery programs are pricey and will require long-range planning. So, where is the Plan?

All this will indeed matter

All this will indeed matter more if Joe Biden wins the presidential election on November 3rd, and especially if the Democrats sweep all three levels of US government and enact far-reaching green projects -- along with cancelling Keystone XL, as promised. That will, of course, put more pressure on Trans Mountain and further illuminate Trudeau's incoherent positions on oil to date.

One can only hope regarding a Democratic win, but hope does not make a plan, which will be necessary for both the above scenario, and another term for Trump. On the latter, Trudeau / Freeland will have to compose a plan to build stronger relationships with all of Canada's other allies.

So where is this Plan?

"Doug Saunders who found that

"Doug Saunders who found that Quebec’s $7 / day childcare program paid for itself over and again" ... and let's not forget that the majority of those women are working in minimum wage jobs, many with no benefits at all.

What we are doing at the moment is just subsidizing employers, who continue to get away with "transitioning" to fewer and fewer employees and more and more expensive and invasive machinery.

The PLAN is staring our

The PLAN is staring our government in the face!

In May of 2019 a poll done for North99 showed that 67% of Canadians were in favour of a wealth tax on the rich. Then, in June of this year, a poll done for the Broadbent Institute showed that 75% of Canadians favoured such a tax,

Meanwhile, in March/April of this year, the CCPA published their annual Alternative Federal Budget which gave the necessary details of how to do it.

I am sure that many of us who read those details rejoiced. I sure did.

The problem with taxing the

The problem with taxing the rich is the same-old, same-old: people who are filthy rich see themselves as being "comfortable." People who are comfortable think of themselves as being needy. People who bring home average Canadian earnings think they don't have enough to get by.

Seniors living on half that much (same rent, same other costs) are seen to be greedy (in addition to having already "taken everything"}, the the poor, god bless'em, think they'd be OK if they could just work another 35 hours a week.

While those already broken by working 12 and 14 hour days, with no days off, for decades, wind up on "disability" or "welfare" and live at less than half any "official" 'poverty line." (Heads up, folks: the poverty line doesn't exist: it's set where whoever's talking wants it to be: so JT spirited 100,000 destitute seniors "out of poverty" and then, just to make sure there was something more left to do, failed to provide a "Low Income/Seniors" poverty line in addition to the CPI, which measures nothing that poor people can afford. That way, he can conveniently overlook the fact that October pension cheques will mark an entire year since they "got" anything ... meanwhile, the feds wiped out disability credits that poor people were able to access, in favor of a much reduced "refunded disability credit" that's available even to the wealthy.

What the PM giveth with one hand, he taketh away with the other.

With his record of throwing women under the bus, I'd be shaking in my boots if I were Ms. Freeland.

Presumably, though, she was on board with all the moves to "protect seniors" by shutting them in indefinitely, in, for a lot of them, substandard housing (beggars can't be choosers) and giving grocery store chains fat employee retention bonuses to shut down half the hours they were previously open, pay the laid-off part-timers CERB, and making it so those who were struggling to eat healthily can now live on dented cans of slop delivered by Walmart (sorry, dieticians: canned fruit is just sugar, just like canned fruit juice: the nutrient benefits are in the fresh stuff).

Wow, that is some impressive

Wow, that is some impressive manipulation of public opinion.

Nothing to do with public

Nothing to do with public opinion. I, too, would like to see the rich taxed. I, too, would have liked very much to see those found hiding assets in tax-free jurisdictions actually *pay* what they owed. But they got to pay pennies on the dollar, those of them who had to pay anything at all.

Meanwhile, mothers consigned to living from foodbanks are harrassed and abused by CRA officials, who think nothing about applying rules that don't exist, just to claw back tax benefits. They largely get away with it, because when you're struggling to eat, you don't have the resources of energy, time, money, to fight back.

How long have you lived in poverty, I wonder, and taken to harvesting weeds from neighbours' boulevards?

I have several such neighbours.

Just FWIW.

Comments