It’s the argument that just won’t die. For more than a decade, Alberta’s oil and gas industry talked up its commitment to reducing emissions and being an “ethical” supplier of oil and gas, and that talk has ramped up in recent weeks as Russia’s invasion of Ukraine roiled energy markets.

As Alberta Energy Minister Sonya Savage tweeted recently, her province “produces energy with the highest environmental standards and is right next door. We are the solution to U.S. energy security, not Venezuela, Iran or Saudi Arabia.”

But now, with the federal government setting an ambitious emissions reduction target for the oil and gas industry of 42 per cent below current levels by 2030, we all get to see if they can actually walk the walk. And they have a lot further to go than they’d like to admit.

The notion that Alberta has the highest environmental standards in the world is practically an article of faith in the corporate towers of downtown Calgary, and it’s one the provincial government trades in almost daily. A New York Times ad paid for by the War Room — or “Friendly Energy,” the name of its latest branding effort — declares: “Our industry is a clear and indisputable global leader in environment, social and governance (ESG) standards.”

But is it?

Yale’s Environmental Performance Index, which ranks countries using 32 performance indicators across 11 issue categories, puts Canada 20th overall — well behind Norway and the United Kingdom, which also produce meaningful volumes of oil and gas, and marginally ahead of the United States.

That’s actually overstating things, too.

When you strip out things like lead exposure and waste management and focus on what really matters to ESG investors — climate change — Canada ranks 37th. That’s a far cry from the United Kingdom (2nd), Norway (6th), or even the United States (15th). Yes, it’s better than Venezuela (44th), Russia (57th) and Saudi Arabia (130th), but those aren’t places that routinely pride themselves on having the best environmental regulations in the world.

Now, it’s time for the ethical oil crowd to put up or shut up. The good news for them is the new federal plan includes a tax credit for carbon capture and storage technology, the details of which have yet to be released. But it’s a safe bet it will match, or at least resemble, the 45Q tax credit in the United States that offers carbon capture projects up to $50 per tonne of CO2 that’s sequestered permanently.

That won’t come close to covering the entire cost of decarbonizing Canada’s oilsands, which has been estimated at $75 billion. But the good news is the industry has more than enough cash to cover the difference. With oil prices trading comfortably above US$100 a barrel and the industry producing the same 1.3 billion barrels it cranked out in 2021, it would cost them less than $50 a barrel to cover the estimated $75-billion cost of eliminating greenhouse gas emissions by 2050.

That’s just in one year, too. If the industry decided to spread out this cost over, say, a decade, it would be less than $5 a barrel. When the average operating cost in Canada is around $35 a barrel, that leaves plenty of room for margin — and profit.

As Prime Minister Justin Trudeau said in his address at the GLOBE Forum taking place this week, “If there’s any oil and gas sector in the world that can do this, it’s Canada’s.” He’s not wrong, but that’s as much a dare as it is an expression of pride, and it’s one the oil and gas industry now has to respond to. Will it rise to the challenge and truly earn its self-appointed title as an ethical source of energy? Or will it shrink from the moment and continue to do business as usual?

Only the industry and its leaders can answer that. For decades, they have bragged about the size of Alberta’s oil reserves. Now it’s time for them to brag about the size of their climate ambition — and do something about it. As the prime minister said, “this is no time for excuses.” Amen to that.

Reminds me of that famous

Reminds me of that famous maths joke with professor writing on a chalkboard already full of equations and adding one final step to arrive at the hoped-for answer “..and now a miracle occurs”

Yeah, hard to imagine. "Pivot

Yeah, hard to imagine. "Pivot" is the word used now, and these guys DO like a challenge. Trudeau encapsulated it nicely by suggesting that their attention shift from the relentless lobbyists to all those engineers and scientists in Calgary instead. That's what he means when he says, "if anyone can do this, it's Canada."

Canada's O&G industry does

Canada's O&G industry does not need, much less deserve, (billions of!) tax dollars to reduce emissions. Clean-up, reclamation, pollution mitigation, and emissions reduction are all part of the cost of doing business.

When a construction company takes a load to the dump, the company pays for it. It passes its waste disposal costs onto its customers. As it should. Not to taxpayers.

Fossil fuel producers and consumers use the sky as a free dump. Violating the polluter-pay principle and free-market rules.

Paying the O&G industry to reduce its emissions undermines the federal carbon pricing plan.

All such flagrant subsidies need to end posthaste.

Is Canada a moral supplier of

Is Canada a moral supplier of asbestos? Tobacco? Landmines?

"Ethical oil" is greenwashing.

Oil markets don't worry about ethics. No one fills up from the Ethical Oil pump. Refineries and consumers buy the cheapest product that meets their needs.

How is it ethical to sell oil to Chinese refineries, but unethical to buy Saudi oil? How is it ethical to sell military vehicles to the Saudis, but unethical to purchase their oil?

An argument of convenience.

*

Fossil fuel companies by their very mission -- to produce fossil fuels for profit as long as possible -- are not socially responsible, climate-conscious, or ethical. They continue to promote obstruction, roll back environmental regulations, and obstruct progress at a critical moment for our future.

The fossil-fuel industry is incontrovertibly opposed to climate action, which will put it out of business. Instead, the fossil-fuel industry is putting us out of business. The interests, aims, and ambitions of the fossil-fuel industry and the public interest are antithetical.

*

Even using the industry's gross under-estimates, Canada's oilpatch is the fourth most carbon-intensive on the planet, behind Algeria, Venezuela, and Cameroon. Almost twice the global average. Burning LESS Canadian heavy oil is a net benefit.

Rystad Energy: "Among the top 10 oil and gas producing countries, Canada had the highest CO2 emission intensity per barrel of oil equivalent."

*

- Oilsands mines and leaking toxic tailings ponds devastate landscape and wildlife, and threaten human health.

- In 2016, the AER found pipeline operators were "insufficiently trained or failed to detect leaks" — and in one third of cases it studied, it took on average 48 DAYS for companies to respond.

- Thousands of inactive and orphaned oil and gas wells in need of clean-up across the province bear testament to AB's slipshod regulations. Some have stood neglected for decades— a "testament to feeble regulation".

- "Canada's oil patch has nearly 100,000 suspended wells, neither active nor capped, and they're a worrying source of planet-warming methane." "These Zombies Threaten the Whole Planet" (NY Times)

- "Alberta issues 97% of reclamation certificates without ever visiting oil and gas sites" (The Narwhal)

- "Many of Alberta's 'reclaimed' wells aren't actually reclaimed: government presentation" (The Narwhal)

- Canadian refineries produce far higher levels of pollution but less oil compared to U.S. refineries.

- Suncor and U.S. refineries export petcoke from AB oilsands to developing nations as a cheap, lethal substitute for coal. Darkening skies and destroying lives.

- Industry and govt are running out the clock on AB's endangered caribou herds, while shooting and poisoning wolves, with untold collateral damage.

- AB's oil & gas industry has barely started to fund its clean-up liabilities: north of $260 billion.

- The industry is turning to taxpayers for bailouts while endlessly milking govts for subsidies.

- Endless oil spills.

- "Oil sands toxins growing rapidly"

- Heavy-oil pollution forced Peace River farm families to abandon their homes. "Families forced from homes settle with Baytex Energy" (CBC)

- Toxic leaking tailings ponds: 220 square km and growing.

- Canada's oil & gas industry grossly under-reports its emissions — of all types.

- Ask Fort McKay residents about oilsands pollution.

- The Alberta Energy Regulator (AER) is a joke. "On its fifth anniversary, Alberta Energy Regulator has made little progress" (Edmonton Journal)

- "Alberta enforcing fewer than one per cent of oilsands environmental violations: Report" (Global News)

"The asset manager BlackRock now lumps the oil sands industry with civilian firearms, tobacco and other pariah sectors."

https://www.ft.com/content/102a1c89-632b-4e41-8af1-4bad95a5b017

So much for ethical oil.

What is very ironic about the

What is very ironic about the hype around the oil industry, "ethical oil" being just one example, is that these arguments and misleading narratives are easily diminished and countered by industry's own data.

The Natural Resources Canada website, which has undergone revisions to defend the Alberta oil sands (or at least offer more apologia) indicates average CO2 emissions from bitumen production and consumption as follows:

Well to retail pump: ~170 kg/barrel

Tailpipe combustion: ~400 kg/barrel

Total: ~570 kg/barrel

The previous NRC website information pegged 60% of per barrel CO2 emissions as occurring within Canada, and 40% in consumer countries as the exported product is further refined and burned in cars in foreign lands. Eliminating exports from total Canadian emissions, the calculation works out to ~340 kg or 0.34 tonnes per barrel in house.

The average per tonne costs per sector of carbon capture is outlined below from a 2021 report by the IEA (US$):

Direct air capture: $143 - 342

Power generation (gas and coal): $50 - 100

Cement: $60 - 120

Iron and steel: $40 - 100

From the same IEA report the cost of transport and storage of CO2 in the onshore US varies between ~$7-24/tonne (median ~$15/tonne).

The report authors mention that utilization of pressurized CO2 to bring the last remnants of oil to the surface in older wells can negate the cost of transport and storage by bringing the recovered product to market. That may explain the oil industry’s delight in federal tax breaks and subsidies for CCUS.

There is no guarantee that pressurized CO2 stored underground will remain there forever. However, some CCUS applications in steel and cement could offer some benefits. In the case of cement, added CO2 hardens the cement and offers higher strength formulations for concrete in addition to concrete that can absorb CO2 in situ for decades. Compared to other larger sectors, though, the overall costs would be lower. However, the evidence indicates that there is an emerging market for green steel and low emission cement, and the Dofasco and Algoma steel plants in Ontario are two recent examples where coal is largely replaced by electric arc furnaces.

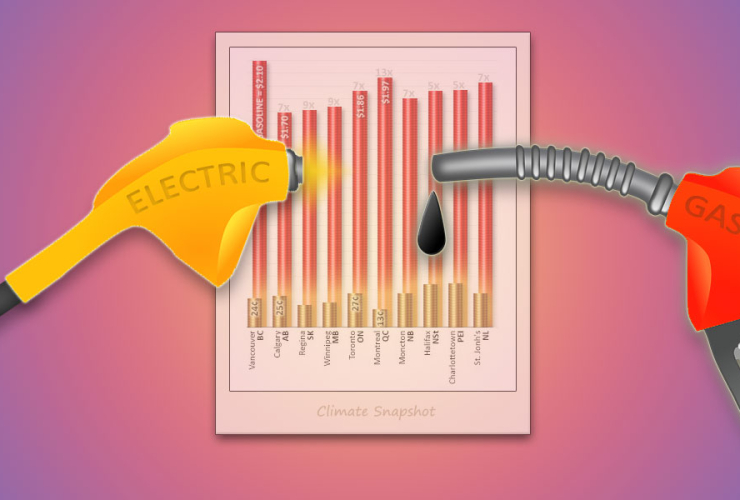

According to Environment and Climate Change Canada statistics, 20% of all national emissions come directly from cars and trucks, the largest share of all emissions from all sectors and of the 28% from all forms of transportation. That works out to 144,000,000 tonnes emitted every year just from tailpipes (2015 data).

There is no feasible way to capture tailpipe emissions at the point source. That leaves direct air capture via newfangled, expensive mechanical technology. Below is a back-of-envelope calculation of the cost to capture, transport and store various levels of tailpipe emissions.

Annual cost of capture of tailpipe CO2 emissions exclusively from cars and trucks directly from the air with mechanical means ($US):

10%: $2.28B - 5.14B *

25%: $5.69B - 12.85B

50%: $11.38 - 25.71B

75%: $17.06B - 38.56B

100%: $22.75B - 51.41B

* Excludes related oil and gas exploration, pipeline and wellhead leaks, marine, air and rail transport. Also excludes other sectors like agriculture, buildings (construction and operations), heavy industry, etc., and embedded emissions in fossil fuel exports and imports.

These annual costs are a minor part of the overall costs of CCUS. Note that the totality of annual subsidies to the collective oil, gas and coal industry amount to roughly the cost of capturing and storing just 10% of the yearly emissions from Canada’s car and truck fleet. It would be interesting to calculate the costs of the natural version of CCS presented by regenerative agriculture and forestry and compare them to the fossil industry’s dreamscape of socialized costs and losses.

It’s apparent that the direct reduction of fossil fuel demand in land transport through displacement with low or zero emission electricity (EVs, electric transit), better urbanism and mixed use zoning to foster walkable neighbourhoods will be far more beneficial and less costly to society.

Comments