Barbados Prime Minister Mia Mottley is leading the charge against an international financial system that puts more people at risk each year as the climate crisis deepens. In an interview with Canada’s National Observer, she outlined what she hopes to see unfold as climate finance negotiations take centre stage this year.

Since her landslide election in 2018, Mottley has emerged on the world stage as a fierce advocate of international financial reform to address the climate crisis and in recent years, has championed a proposal called the Bridgetown Initiative that aims to do just that.

Following last year’s UN climate summit, where countries agreed for the first time to transition off fossil fuels, the top priority this year is widely expected to involve tough negotiations on how to pay for the energy transition. Mottley will be at the forefront of these conversations.

For the world to reach net-zero greenhouse gas emissions by 2050, economies will need to spend around $125 trillion in coming decades to phase out fossil fuels while scaling up alternatives, according to the UN’s climate change arm. Other estimates peg it higher, with BloombergNEF estimating almost $200 trillion over that period. To find the cash, Mottley says major reforms are required.

For the good of the climate, the way we build, eat and move need to be decarbonized and “finance is the oxygen that propels us,” she said in an interview with Canada’s National Observer during the annual UN climate negotiations in Dubai.

Mottley intends to catapult her Bridgetown Initiative into the mainstream. The goal of this plan is to overhaul the financial system by injecting billions of dollars into it to support vulnerable countries’ ability to cut emissions, adapt to climate change and deal with natural disasters.

The plan involves immediate steps, like providing emergency cash to developing countries to “stop the debt crisis in its tracks.” As well, Mottley advocates reforming multilateral development banks, like the World Bank, so they can pump an additional $1 trillion into the global financial system to support countries.

Taxing oil and gas companies, as well as global shipping, could raise billions, she said. But beyond these changes, Mottley believes she’s identified an important revenue stream that could generate hundreds of billions of dollars without straining the financial system.

“You have financial transactions being done every day [and] we're going to need to be able to take a percentage of that,” she told Canada’s National Observer. She isn’t talking about much: a 0.1 per cent charge on every financial transaction could raise more than $400 billion annually, she said.

“But climate is not the only thing we need to fix as a global public good. We need to deal with pandemics. We need to deal with the consequences of war and fragility. We need to deal with the digital divide. We need to deal with food and water security,” she said. “So, maybe we should be at 0.25 per cent [tax], which would raise $1 trillion, and that be spread out between the various global public goods of which climate will obviously get the lion's share.”

“The beauty of these things is that they're recurring, and therefore create a new framework by which the world can save itself, and save people, without having to go through the false dichotomy that I will put one [issue] above the other,” she said.

Without naming it, Mottley is attempting to resurrect an old idea in financial circles and bring it from the national level to the international. In the early 1970s, Nobel-winning economist James Tobin proposed a tax on transactions — now called a Tobin tax.

Sand in the spinning wheel of finance

“Tobin called it just throwing a little bit of sand in the spinning wheel of global finance, just to slow it down a little bit, but also get some revenues out of it,” explained Louis Pauly, a University of Toronto professor of political economy. “Great idea. It's almost like free money. But it never went anywhere.”

The idea hasn’t gained traction because we live in a world where competitive instincts overpower co-operative ones, Pauly said. If everyone could agree to be in the same boat and levy the same tax on transactions, it would be possible and could generate hundreds of billions annually to prevent catastrophic climate change. But countries are not in the same boat.

This isn’t just a question of political will, said Pauly. It’s about the ability to elevate levying taxes — something countries do internally — to a higher authority; likely a new institution. That is an incredibly difficult task.

Mottley concedes as much, telling Canada’s National Observer she believes there’s a possibility, but it does mean “changing the paradigm” of how taxes are collected. She also emphasized that reforming global finance is only the first step.

“Ironically, the destination is not the completion of the financial reform. The destination is the execution of the projects that protect us, both pre-disaster and allow us to recover post-disaster,” she said.

Environment and Climate Change Minister Steven Guilbeault told Canada’s National Observer he “greatly admires” Mottley and the Bridgetown Initiative and said her proposal is gaining traction.

“Informally, it's become the road map internationally for what we need to do in terms of financial reforms and I think Canada is very supportive of many of the elements that are there,” he said.

Guilbeault added his government is working on a host of international financial issues, including multilateral development bank reform, loss and damage and delivering on a promise rich countries made to developing countries to provide $100 billion worth of finance to help cut planet-warming greenhouse gas emissions and adapt to climate change.

Disaster opportunities

For Mottley, “changing the paradigm” of global finance involves more than encouraging countries to work collaboratively.

“This is a case where all hands have to be on deck,” she said. Individuals, companies, philanthropies and governments all have to play their part. Progress is being made across a number of related issues, like countries contributing to a loss and damage fund, restructuring debt payments vulnerable countries make to create more breathing room in their budgets, and rich countries redirecting their “special drawing rights” under the International Monetary Fund (IMF) to developing countries that can help provide greater financial flexibility in moments of crisis. Special drawing rights are a financial tool that gives countries the right to borrow more money from the IMF. In September, Canada announced it would make available 48 per cent of its special drawing rights valued at $1.3 billion worth of additional financing for lower-income countries.

That amount is “one of the highest in the world, and we thank Canada for that,” Mottley said, but it’s not enough on its own to reform global finance the way she wants.

“Remember, I say finance is not the destination, it's the actual projects that are implemented that lead to new ways of building houses, new ways of farming, new ways of transport,” she said.

“We're not going to get [the amount of money needed] purely from countries’ contributions and therefore, there has to be … a mature, realistic conversation across the world about how everybody in the world will play their part.”

These discussions promise to be difficult, but boil down to a simple question: We’re in the early days of the climate crisis and know it will only get worse, so will we change course before total catastrophe hits?

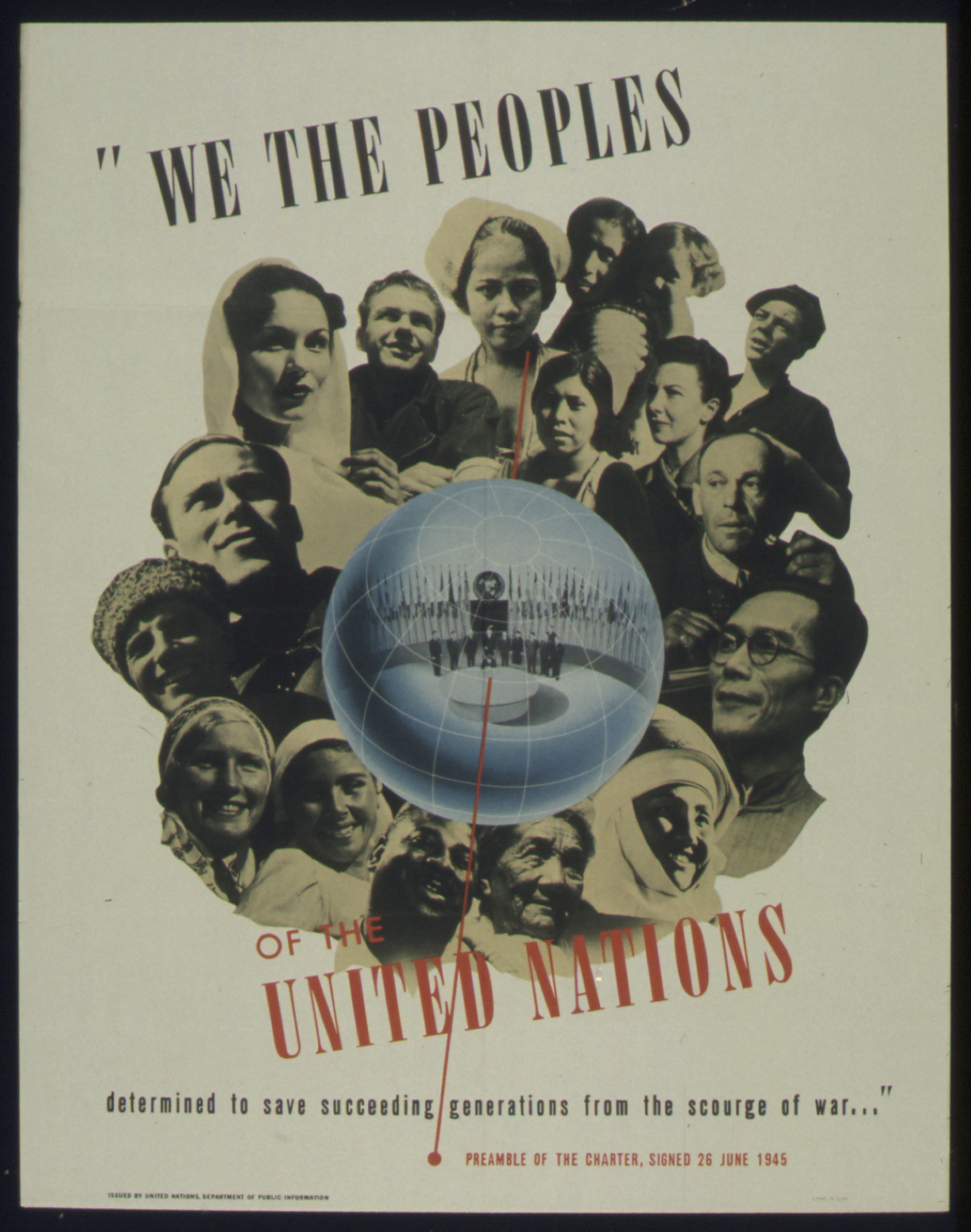

If history is any guide, a catastrophic crisis might be what’s needed, suggested Pauly. After the Second World War, the United Nations was set up and the global financial system as we know it was established –– both examples of international institutions built to manage global affairs after a devastating crisis.

History is packed with examples of crises leading to new innovative solutions, but it’s also filled with moments where a crisis went unresolved and no solution was found.

Nuclear weapons have proliferated for decades without a higher power successfully compelling countries to dismantle arms that could mean unprecedented death and destruction. Millions died during the COVID-19 pandemic without the World Health Organization being significantly empowered to prevent and manage global pandemics.

Catastrophe and devastation don’t always push society in a better direction, Pauly said. That’s a problem when it comes to climate change, which is already hitting hard.

From nuclear weapons to pandemics and financial issues related to climate change, the logic remains the same: Better institutional structures are needed, he said.

“[Can we] have an adult conversation about moving authority collectively, collaboratively, to the right level? Can we do this through persuasion? Through education? Through adult conversations?... Or does history tell us we need a catastrophe to motivate us?” he said.

“Maybe there's more than catastrophe that's required.”

I dutifully skimmed down to

I dutifully skimmed down to the bottom, waiting for the punch line, but no, you're serious.

If this isn't a joke, it's an insult to the reader's intelligence. She is Prime Minister of one of the world's more-popular tax havens, it's the #3 favourite destination for Canadian money to avoid the taxes that PAY FOR THAT CLIMATE FUND.

She's the enemy, she's the one keeping the money from going into climate. Instead, it goes into tax-free corporate banks in Barbados. The !@#$#%$ing nerve of her, saying "we should skim off the transactions with a new tax and pay it to me", when she's profiting off the dodging of the taxes we DO have. We wouldn't need this proposal if it weren't for tax havens, and the reason it's never gone anywhere is the same as the reason the tax havens even exist: rich people don't want to pay taxes and have the power to prevent it.

I assume, including the power to toss her out of office if she were to suggest taxing the money in Barbados banks to save Barbados from rising seas, which is why she isn't bringing up THAT idea.

https://www.cbc.ca/news

https://www.cbc.ca/news/business/canada-offshore-treaties-barbados-tax-a...

$80B of Canadian money parked in Barbados, would have given us at least $12B in corporate taxes.

Oh man, this idea is a

Oh man, this idea is a perfect recipe for waste, inefficiency, and corruption at a level never seen before by any nation.

I agree and I can only

I agree and I can only imagine the corruption in all these Charity donations to the CHILDREN - I would think that people would find better ways of sending money to help other nations. Half of it is probably gone by the time it gets there, then another half for favours, by the time it gets to the CHILDREN is nothing and no wonder we never see much improvement. I Haiti for example I doubt any money gets to the people that need it.

Comments