The two Crown corporations that the Trudeau government has corralled to offer over a billion dollars in loans for struggling oilpatch businesses say they are providing this financing out of their existing capital and programs, and one says it learned about the new program two weeks before the minister's announcement.

For Export Development Canada (EDC), it also means a simpler process is behind the offer to provide this billion-dollar loan than the loans it is managing connected with Ottawa's move earlier this year to purchase the troubled Trans Mountain pipeline.

Prime Minister Justin Trudeau is trying to navigate a battle pitching Alberta and its energy industry against environmentalists and British Columbia over getting oil products to international markets and working towards a low-carbon future.

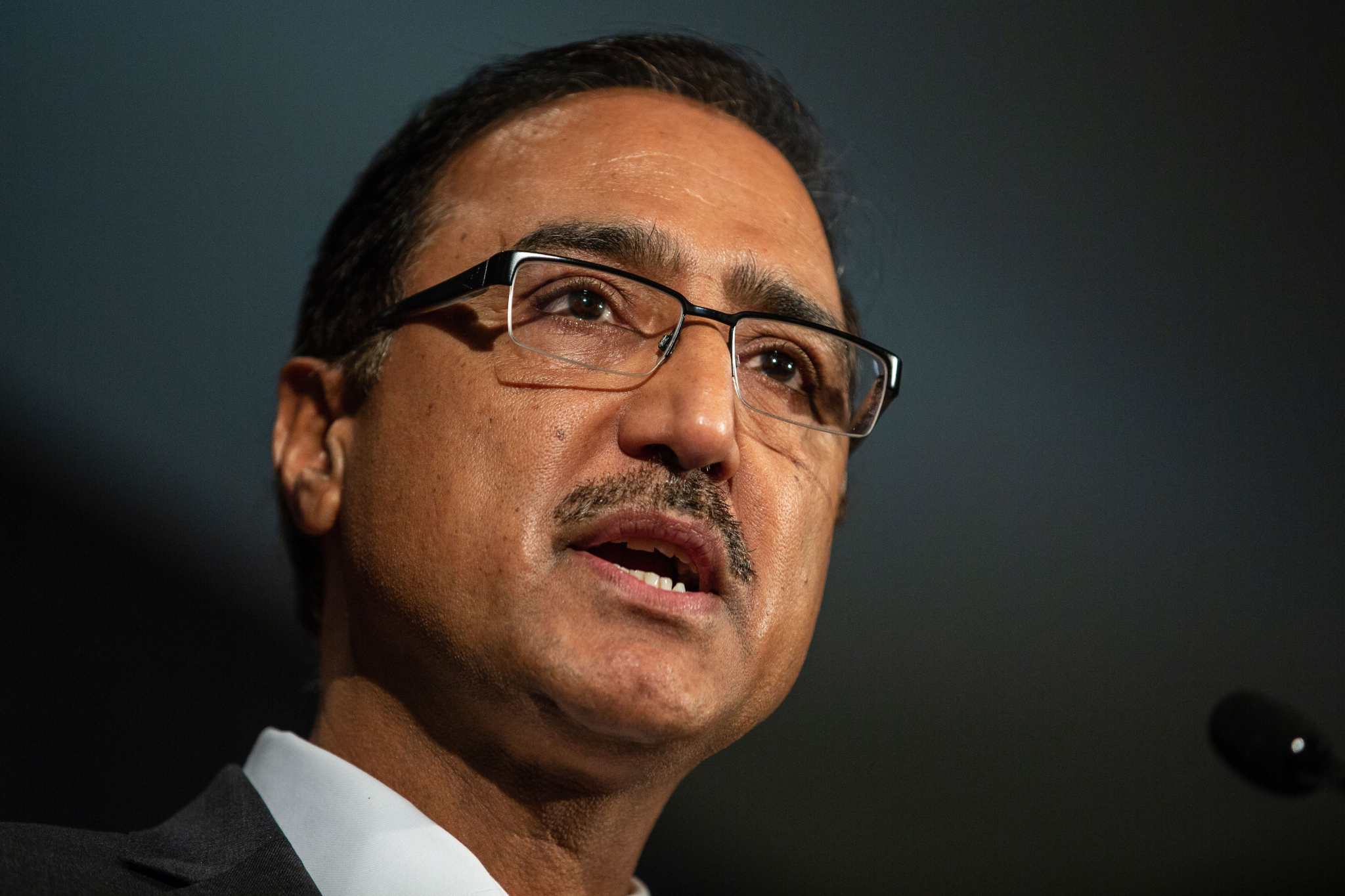

On Tuesday, Natural Resources Minister Amarjeet Sohi announced that EDC would be making $1 billion available to oil and gas exporters to help them invest in new technology and address liquidity concerns.

He also said the Business Development Bank of Canada (BDC) will be creating a $500 million "energy diversification" financing program for higher-risk oilpatch firms to deal with market uncertainty.

The loans were met with skepticism by the Alberta government. When Premier Rachel Notley was asked by media whether she was disappointed with the offer, she argued the justification for the loans as supporting “developing export markets” made little sense.

“I hate to break it to you, but the whole world wants our product. The issue is not finding a market for our product. The issue is getting our product to that market,” Notley said.

"We don't need help finding more markets, we need help moving our product. I don't know that we could have been much more clear about that."

Alberta has been frustrated by a transport bottleneck that is leading to crude oil storage units becoming entirely filled up in the province and oil being sold cheaply, what the premier has described as "an extraordinary and punishing oil price crisis." She has curtailed production in the province, sought proposals from private companies to build or expand oil refineries, and has floated a plan to push more oil-by-rail.

When Ottawa ordered EDC, which operates at arms-length from the government, to help finance its purchase of the Trans Mountain pipeline and expansion project after Finance Minister Bill Morneau announced the plan on May 29, the Crown corporation said it had to first talk to government officials to figure out what to do about the offer.

By the summer it had struck a deal with Royal Bank of Canada and Toronto-Dominion Bank to help finance the pipeline purchase. That billion dollar-plus loan guarantee was connected with a federal fund called the Canada Account that EDC manages, but under which taxpayers ultimately assume the risks.

The agency then created a second financing product to lend money to a subsidiary of another Crown corporation, the Canada Development Investment Corporation (CDEV). Before Trans Mountain, CDEV managed two other entities for years: Canada's interest in the Hibernia offshore oil project, and liabilities and retiree benefits related to a decommissioned uranium mine.

The subsidiary, called “Project Deliver I” and which later changed its name to Canada TMP Finance, borrowed $5.2 billion from the Canada Account. Transactions from that account are considered to be in Canada's national interest, but which EDC is unable to support due to a combination of market, borrower and other risks.

Unlike the elaborate Trans Mountain setup, however, the billion-dollar loan described by Sohi on Tuesday is not coming from the taxpayer-backed Canada Account, confirmed Shelley Maclean, principal advisor for EDC.

Maclean described the loan as additional financing that will be set aside for companies in the oil and gas sector, which is on top of the regular support EDC was already planning to provide to the sector over the next three years. She also said there hadn’t been a directive yet issued to EDC to make the loan available. Maclean did not immediately respond to a followup request about the details of the three-year sector support.

“The $1 billion represents commercial financing, insurance, and bonding support that will be made available to viable companies of all sizes who need working capital support to maintain operations through this time of reduced (oil) prices,” said Maclean.

Similarly, Jean Philippe Nadeau, BDC external communications advisor, said the $500 million in financing for energy diversification that the bank is offering is coming out of its existing capital.

BDC found out about the government’s latest financing effort “in the first week of December,” he said, or about two weeks before Sohi unveiled the $500 million loan. He added that “the decision to create a (financing) envelope was a BDC decision.”

Comments