Prime Minister Justin Trudeau vowed to put more money into the pockets of residents of Ontario and three other provinces as he forged ahead Tuesday with plans to fight climate change by imposing a new price on pollution in April.

The federal price will apply in Canada's most populous province, as well as Saskatchewan, Manitoba and New Brunswick — all provinces which declined to impose their own minimum price on the heat-trapping pollution that contributes to global warming. But residents in these jurisdictions also stand to benefit from federal rebates as part of the government's plan.

The federal rebates are intended to compensate Canadians for the extra charges when they purchase fossil fuels, which pollute the atmosphere when they are burned to create energy. This includes gasoline for cars and natural gas for home heating, for instance. The federal plan will also impose an emissions trading system on large industries.

Ottawa insists that these jurisdictions will receive more money back than they pay in increased costs.

Trudeau spoke publicly for the first time about a recent major international assessment by a United Nations scientific panel that said humanity has fewer than 12 years to take action to prevent devastating ecological and economic damage triggered by human activity. He took aim at conservative politicians who refuse to implement effective climate change policies, explaining that the time to act is now.

“Unfortunately, the conservative movement in this country is determined not to act on the environment," Trudeau said in a morning radio interview with the CBC in Toronto.

"It has not acted in the past on the environment and it’s still trying to put off the challenge, and people know, now is the time to act. Future generations will look back at this moment as the last opportunity we had to act, and we are going to make real change happen in bringing in a price on pollution. We refuse to allow pollution to continue to be free. The Conservatives want pollution to be free and we’re not going to do that."

The international assessment by the Intergovernmental Panel on Climate Change, provided a roadmap showing how humanity could limit devastating impacts of climate change that are already affecting countries around the world.

"The real problem is that pollution is free, and therefore we are polluting too much," Trudeau said later on Tuesday, at a town hall event with students at Humber College in Toronto. "The world's leading scientists told us a few weeks ago that we just have 12 years left to make a real change."

Starting next year, it will no longer be "free to pollute anywhere in Canada," he said. "This is not about politics or about the next election. This is about leadership, this is about seeing this problem and this solution for what it is: a moral and economic imperative to act."

Tories to unveil plan at future date

Many conservative-leaning politicians across the country, including federal Opposition Leader Andrew Scheer, have vowed to stop Trudeau's plans to put a price on carbon, without offering any alternative plan to fight climate change.

The federal government says its plan will reduce greenhouse gas pollution by 50 to 60 million tonnes by 2022. Canada's carbon pollution in 2016 was 704 megatonnes of carbon dioxide equivalent; the government has promised to reduce emissions by 30 per cent from 2005 levels by 2030.

But it says its latest estimates are weaker than it had previously anticipated because of the actions of Ontario Progressive Conservative Premier Doug Ford, who was elected in June. Ford pulled Ontario from a carbon emissions trading market with Quebec and California and cancelled an array of energy-saving projects and programs initiated by the defeated Liberal government.

In the interview with CBC, Trudeau noted that some jurisdictions such as Quebec and British Columbia will not be affected by the federal government's new actions since they have already established credible climate change policies that are protecting their environment and growing their economies to the benefit of citizens.

Speaking Tuesday outside the House of Commons, Scheer said his party is still working on a plan, which he said he would be "unveiling" at a future date. He attacked Trudeau's plan as "wrong for taxpayers," because the system provides certain exemptions for polluters to ensure business competitiveness.

“Canadians won't be tricked by this. They know an election gimmick when they see one,” said Scheer.

In a statement, Ford also came out swinging against Trudeau, stating he "does not have the right to ram a carbon tax down the throats of Ontario families and job-creators" and claiming the rebates aren't as advertised.

“The people of Canada are too smart to believe that Trudeau’s phony rebates are anything more than a temporary vote-buying scheme that will be discarded once the election is over. In contrast, the carbon tax rip-off is forever," he said in a prepared statement. “The Trudeau carbon tax does nothing for the environment."

The Ford government has pulled out all the stops to attack Trudeau's plan to price pollution. Ford travelled to Calgary this month to rally with Jason Kenney, leader of Alberta's Opposition United Conservative Party, against carbon pricing. Ford called it "the worst tax ever."

Even so, on Tuesday Ontario Environment Minister Rod Phillips said in an interview that his government has made "various attempts to work collaboratively with the federal government." Phillips did not receive advance notice of Trudeau's announcement.

"These efforts have been met with silence," Phillips said. "In truth, they are not interested in a plan, they are interested in a tax...we received a mandate from the people of Ontario, not only to cancel the ineffective cap-and-trade program of the previous Liberal government, but to challenge the federal government’s authority to impose this unconstitutional carbon tax on the people of Ontario.”

Ontario residents to get average payment of $300

In Ontario, the Trudeau government estimates that residents will get an average payment of $300 when its fossil fuel tax rebates start kicking in next year.

The federal fuel tax will apply starting in April 2019, in Saskatchewan, Ontario, Manitoba, and New Brunswick. This pushes back the start date by a few months; the Liberals had originally said it would start Jan. 1.

The pollution-based emissions trading system for facilities like manufacturing plants, isn't expected to kick in for another year and a half, federal officials confirmed. When it does, the money will be returned to the "jurisdiction," not to individuals in the province. They said more details about this would be provided later.

For those four provinces where provincial governments haven't met the federal standard for pricing pollution or don't have any system at all, the government plans to send fuel tax rebates directly to individuals through the Canadian tax system.

The estimated costs are different depending on the province and territory, and the average rebates are different too, and change over time.

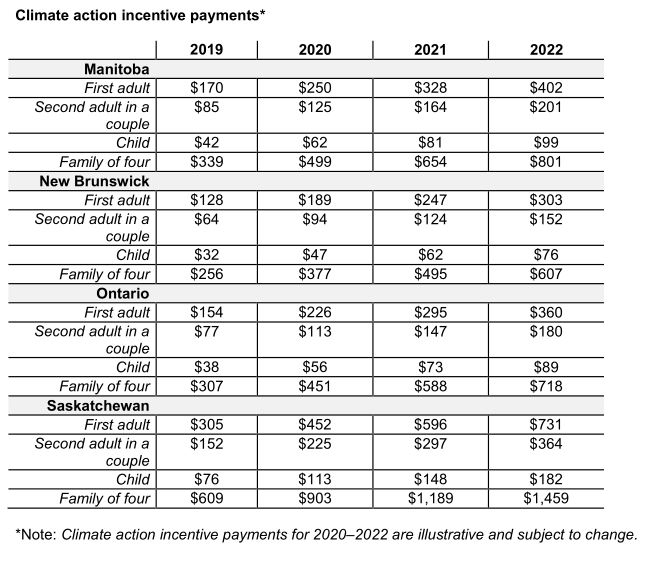

For example, in Ontario, the average cost impact per household in 2019 would be $244, with a $300 rebate. In 2022, the cost rises to $564, with a rebate of $697. In New Brunswick, the average cost in 2019 is $202, with a rebate of $248. That will rise to a $470 cost and $583 payout in 2022 in New Brunswick.

The payouts are further broken down by the individual's relationship to the household, although the government notes that the payments for 2020–2022 are subject to change.

In Manitoba in 2019, for example, the "first adult" would receive an average of $170, the "second adult in a couple" would receive $85, a child would receive $42 and a "family of four," $339.

The government is calling this the "Climate Action Incentive." There will be a schedule to claim the rebate on individual tax returns for residents of those provinces. Claims are made on a family basis, such as the number of family members.The first payments will be made after 2018 tax returns are filed.

"Families will be better off because of the carbon incentive we are returning to them, the climate change incentive," Trudeau told CBC News.

About 90 percent of the fuel tax will be returned to residents through rebates, officials said. The remainder will be provided to small and medium-sized businesses, schools, hospitals and other objectives.

Meanwhile, the money collected in future from large polluters will be directed towards energy efficiency measures, they added. Government officials declined to provide details about how their proposed system for these industry polluters would work.

May, green groups praise initiative

Speaking outside the House of Commons on Tuesday, Green Party Leader Elizabeth May commended the Trudeau government for moving forward with a “carbon fee and dividend” model that she noted has been endorsed by former NASA climate scientist James Hansen as well as right-leaning economists and politicians.

She called it a "good start" and "a very fundamental first step to get the market forces right," but added the message to Trudeau and Environment and Climate Change Minister Catherine McKenna needed to be "tough love." Canada has said its 2030 target won't be met without additional measures, like investments in public transit and green infrastructure.

The Oct. 8 international assessment called for drastic shifts now, like cutting carbon pollution almost in half roughly over the next decade. “It must be repeated: Canada's current target is inconsistent with Paris (climate agreement), it always was,” said May.

“Like the captain of the Titanic," she said, Canada has set a course, and spotted the iceberg, but hasn't changed course yet.

Catherine Abreu, executive director of Climate Action Network Canada, said in a statement that the government "refused to bow to industry pressure and provincial politicking today by following through with its commitment to introduce nationwide carbon pricing."

"Political leaders in provinces and in Ottawa who continue to pretend pollution is free and score cheap points with the denial of climate action are doing a criminal disservice to Canadians," Abreu's statement reads.

"Pollution has a price. We Canadians pay that price every day in the form of health care costs exacerbated by poor air quality, insurance costs that soar after floods and forest fires, and the loss of natural ecosystems and non-human species that keep our world in balance and enrich our lives. It is only fair that big polluters finally join us in paying the price of pollution."

Merran Smith, executive director at Clean Energy Canada, also said in a statement that the government was taking the right approach. “In fact, most Canadians will come out ahead, with bigger tax rebates than what carbon pricing costs them," said Smith.

“While there aren’t many politicians in Canada who still deny the science of climate change, many still deny that there are practical solutions—or simply refuse to show their hand. Frankly, that’s just as reckless."

Notley has refused to scale up carbon pricing plan

Canada's carbon pollution reduction estimates reflect a number of assumptions, not least of which is that it assumes Alberta will continue raising its carbon price to align with federal standards.

Alberta Premier Rachel Notley has said she will refuse to do that until the federal government gets the Trans Mountain pipeine expansion, that it bought this year for $4.5 billion, back on track to be built.

The federal government's approval to build the pipeline was revoked by the courts this summer and it is now undergoing a new National Energy Board process, among other initiatives. While Trudeau has said that this project is essential to securing Alberta's support for his national climate change policies, anti-pipeline opponents have said that pursuing the Trans Mountain expansion would lead to growth in carbon pollution that pushes Canada's climate change goals out of reach.

The estimated prices also reflect new calculations that the federal government had to undergo, after Ontario Premier Doug Ford decided to abandon his province's cap and trade system.

Federal public servants never analyzed the full impact of a national price on carbon in Canada's most populous province, and had to scramble to hold additional meetings as a result of Ford's decision, senior officials admitted Aug. 2.

"Carbon-pollution pricing will make a significant contribution toward meeting Canada’s greenhouse gas reduction target. It will cut carbon pollution by 50 to 60 million tonnes in 2022. This is lower than the April 2018 estimate, mostly because of Ontario’s decision to cancel its cap-and-trade system," reads briefing notes provided by Environment and Climate Change Canada.

Monique Moreau, vice-president of national affairs at the Canadian Federation of Independent Business (CFIB), said she was concerned the federal government’s climate plan will favour consumers and big firms over small business.

Small businesses “are not benefitting from the rebates like consumers, and they’re too small to benefit from the bigger funds large emitters are able to apply for,” Moreau told National Observer in a phone call. Trudeau’s price on pollution is going to feel like a hefty tax, she noted.

The CFIB is closely monitoring the government’s proposed $2 billion climate fund for small businesses, she added.

“If its easy to apply for or you get it automatically as a tax credit then that changes the game a bit,” she said.

“For us, it's about fairness and competitiveness, so if consumers are able to get this money without having to apply for it and big businesses are able to dip into these bigger funds to get their pollution paid for then we need to make it easy for small businesses too.”

with files from Fatima Syed

Editor's note: This story was updated at 2:00 p.m. EDT and 4:00 p.m. EDT to include additional quotes and information.

I wonder if the Toronto Sun

I wonder if the Toronto Sun readers will still passionately hate Trudeau and accuse him of ridiculous non-existent acts of horror as they're cashing their checks? According to them, they are unable to feed their families and it is all due to Trudeau and his carbon tax making their tax burden exceed their incomes. They are literally starving and their families are being torn apart by liberals who hate them because they are white.

I suspect I am like many, if

I suspect I am like many, if not most Canadians in failing to understand the economics of the Prime Ministers Carbon plan - or its ultimate utility in reducing said carbon and supporting the development of the "green" and sustainable technologies we so desperately need.

If the rebates are just an election gimmick then the Liberal party is engaged in a dangerous and deceptive shell game and playing politics with the climate threats looming over us all. Are they fiddling while the world burns?

Have they decided that nothing they do will improve matters so why not make short term political hay?

Certainly I agree that the polluters must be reined in and that our economy must be re-engineered - and quickly! What I have not been able to grasp is how this plan will produce either result!

Comments